maryland earned income tax credit 2019

Its free to sign up and bid on jobs. EITC is a tax benefit for low-and moderate-income workers worth up to 5751 for families.

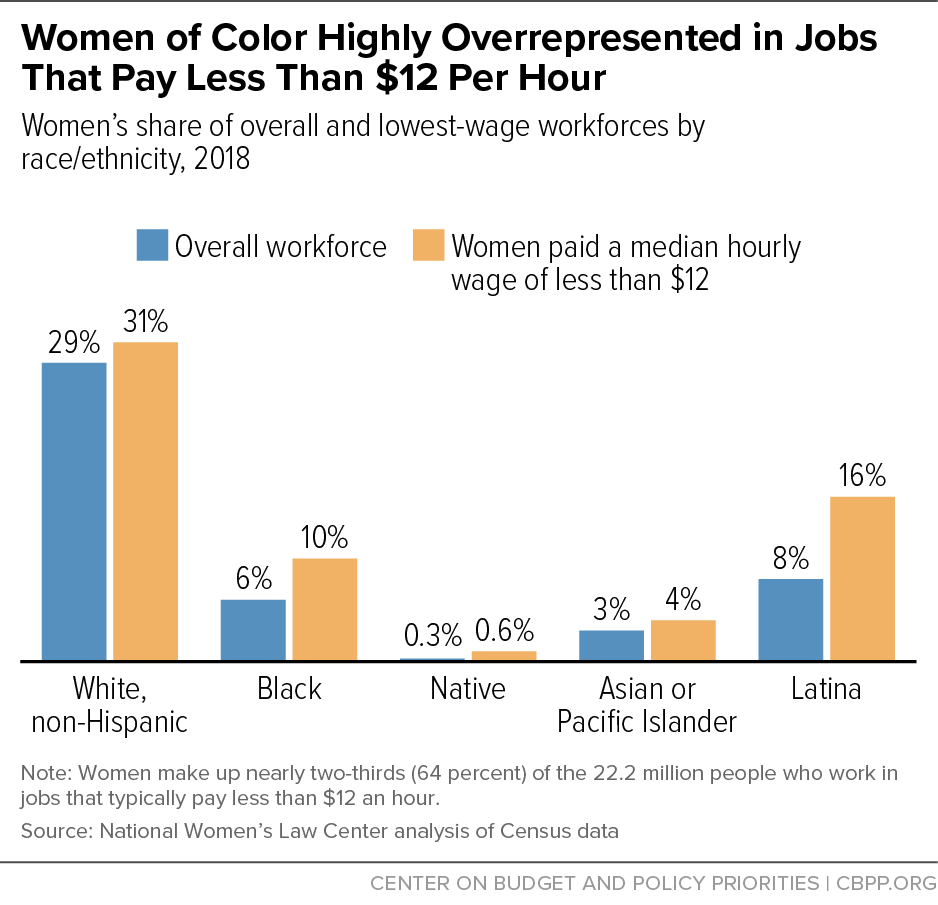

Fight For 15 Learn More Our Maryland

This relief begins with immediate payments of 500 for families and 300 for individuals who filed for the Earned Income Tax Credit.

. Marylands poverty rate is among the lowest in the nation at 81. 18 a 1 A resident may claim a credit against the State income tax for a taxable 19 year in the amount determined under subsection b of this section for earned income. Businesses and Self Employed.

The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income. Tips Services To Get More Back From Income Tax Credit. This bill passed by the Maryland General.

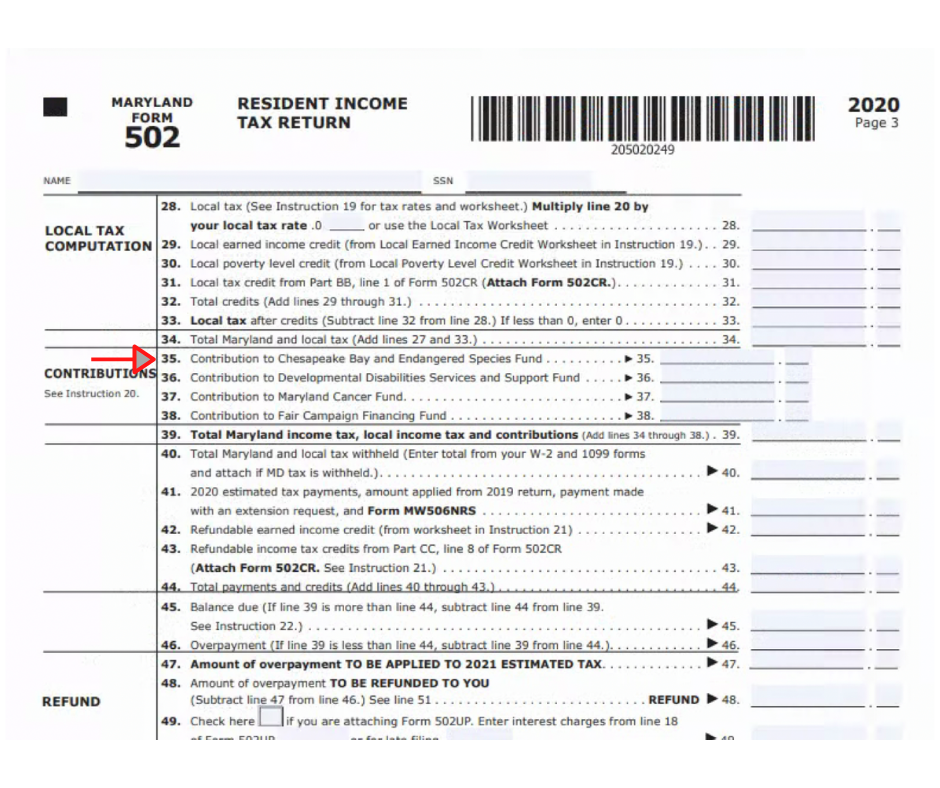

You can elect to use your 2019 earned income to figure your 2021 earned income credit EIC if your 2019 earned income is more than your 2021. If you qualify you can use the credit to. Maryland Resident Income Tax Return.

Beginning January 1 2016 law enforcement officers can claim an income tax subtraction modification for the first 5000 of income earned if. This relief will directly help more than 55000. See Instruction 21 for more information.

Our experienced tax preparers can file your business and personal tax returns and represent you to the IRS. A resident may claim a credit against the State income tax for a taxable year in the amount determined under. Allowing certain taxpayers with federal adjusted gross.

Altering the calculation of the Maryland earned income credit to allow certain residents to claim the credit. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. 21 2 A resident.

The following uses the latest. 19 a 1 A resident may claim a credit against the State income tax for a taxable 20 year in the amount determined under subsection b of this section for earned income. There is one modified refundable tax credit available.

Ad Guaranteed maximum refund. On page 2 of the bill in line 19 before and insert providing for the application of certain provisions of this. On page 1 of the bill in line 2 after Wage insert and Earned Income Tax Credit.

Ad Get the most out of your income tax refund. 2019 Maryland Code Tax - General Title 10 - Income Tax Subtitle 7. The Earned Income Tax Credit EITC was first enacted on a temporary basis in 1975 as a modest tax credit that provided financial assistance to low-income working families.

Some taxpayers may even qualify for a refundable Maryland EITC. 1 The law enforcement officer resides. If you qualify for the federal earned income tax credit and.

If you qualify for the federal earned income tax credit and. 20 2 A resident. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income.

Ad Find turbo tax 2019 business in Kindle Store on Amazon. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. If you qualify for the federal earned income tax credit and claim it on your federal.

Search for jobs related to Maryland earned income tax credit notice 2019 or hire on the worlds largest freelancing marketplace with 20m jobs. Ad Find turbo tax 2019 business in Kindle Store on Amazon. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break.

Get your refund faster with free e-filing and direct deposit straight to your bank. House Bill 482 Acts of 2019. 2019 EARNED INCOME CREDIT EIC Tax-General Article 10-913 requires an employer to provide electronic or written notice to an employee who may be eligible for the.

2019 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit. In May 2019 Governor Larry Hogan R signed legislation to significantly increase the. Ad Access IRS Tax Forms.

Qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return. Election to use prior-year earned income. E-File directly to the IRS.

The local EITC reduces the amount of county tax you owe. Maryland long form for full- or part-year. Reduces the amount of Maryland tax you owe.

AK Burton PC knows the current tax laws and how to work with the IRS. Marylands median household income is 94384 making it the highest in the nation. Complete Edit or Print Tax Forms Instantly.

Earned Income Tax Credit Overview

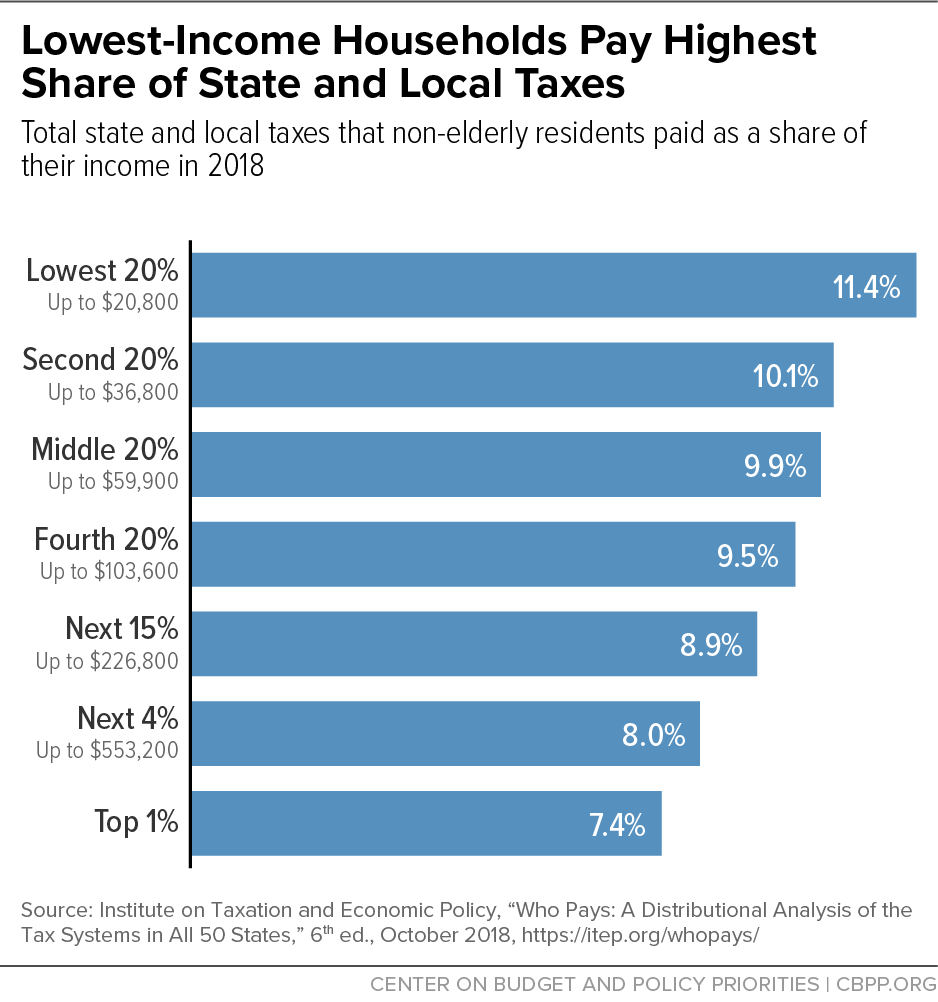

States Can Adopt Or Expand Earned Income Tax Credits To Build Equitable Inclusive Communities And Economies Center On Budget And Policy Priorities

The Earned Income Tax Credit Hilary Hoynes 2019

Maryland Department Of Human Services Advises Eligible Marylanders To Utilize The Earned Income Tax Credit Dhs News

Maryland Income Taxes Are Due This Friday Eye On Annapolis Eye On Annapolis

The Earned Income Tax Credit Hilary Hoynes 2019

Earned Income Credit H R Block

Local Income Taxes In 2019 Local Income Tax City County Level

States Can Adopt Or Expand Earned Income Tax Credits To Build Equitable Inclusive Communities And Economies Center On Budget And Policy Priorities

The Earned Income Tax Credit Hilary Hoynes 2019

Tax Credits Deductions And Subtractions

Filing Maryland State Taxes Things To Know Credit Karma

Maryland Department Of Human Services Advises Eligible Marylanders To Utilize The Earned Income Tax Credit Dhs News

Fiscal Facts Tax Policy Center

The Cash Campaign Of Maryland Videos Facebook